How to Make Your Clients Pay on Time: 7 Nifty Nudges

Perennially facing delays in client payments? Use these subtle tactics and non-awkward ways to get the message across, and make sure your cash flow is not affected.

Perennially facing delays in client payments? Use these subtle tactics and non-awkward ways to get the message across, and make sure your cash flow is not affected.

Running a business means juggling many responsibilities, but few are as crucial as maintaining healthy cash flow. And let’s be honest — waiting for clients to pay their invoices can feel like watching paint dry, except with mounting anxiety about making payroll or covering critical expenses.

Late payments aren’t just frustrating; they can seriously threaten your business’s financial stability. A U.S. Bank study famously found that 82% of small businesses fail due to poor cash flow management!

So before you resort to sending strongly-worded emails or making awkward phone calls, let’s explore some clever, relationship-preserving approaches to get those payments flowing in on time.

Ambiguity is the enemy of prompt payment. When clients aren’t sure when or how to pay, delays become the norm.

This is why you should never, ever begin without a contract that specifies exactly what you get paid for and when. Invoices, emails and verbal agreements aren’t necessarily legally binding but a contract is just that.

Image source: https://usesignhouse.com/contracts/payment-agreement-template/

Smart Tips: Include detailed payment terms in your proposals, contracts and invoices that specify

For example, instead of “Payment due upon receipt,” try “Payment due within 15 days of invoice date. A 2% discount applies to payments received within 7 days.”

The harder it is to pay you, the longer clients will put it off. Think about your own behavior as a consumer — you’re more likely to handle tasks that take a couple of minutes (and you know exactly how to go about) rather than those requiring multiple steps, aren’t you?

Smart Tips: Offer multiple convenient payment options.

One manufacturing company we worked with increased on-time payments by 40% simply by adding a “Pay Now” button to their digital invoices.

Don’t wait days or weeks on end for money you’ve already earned.

Secure up to 90% advance rates on unpaid invoices in as little as 24 hours.

Strategic invoice timing can significantly improve payment speed. Many businesses send invoices at the end of the month, creating a bottleneck in their clients’ accounts payable departments.

Smart Tips: Consider these timing strategies:

People respond to visual cues. Make your payment due dates stand out with design elements that create urgency without being aggressive.

Image source: https://support.countingup.com/hc/en-us/articles/11722273200029-How-do-I-create-a-payment-reminder

Smart Tips: Some online and on-paper graphic cues you could use:

Sometimes a small financial nudge makes all the difference in payment prioritization.

Smart Tips: Gamify payments with small rewards.

One retail supplier I know offers “payment points” that accumulate with each on-time payment and can be redeemed for priority shipping or extended payment terms during slow seasons.

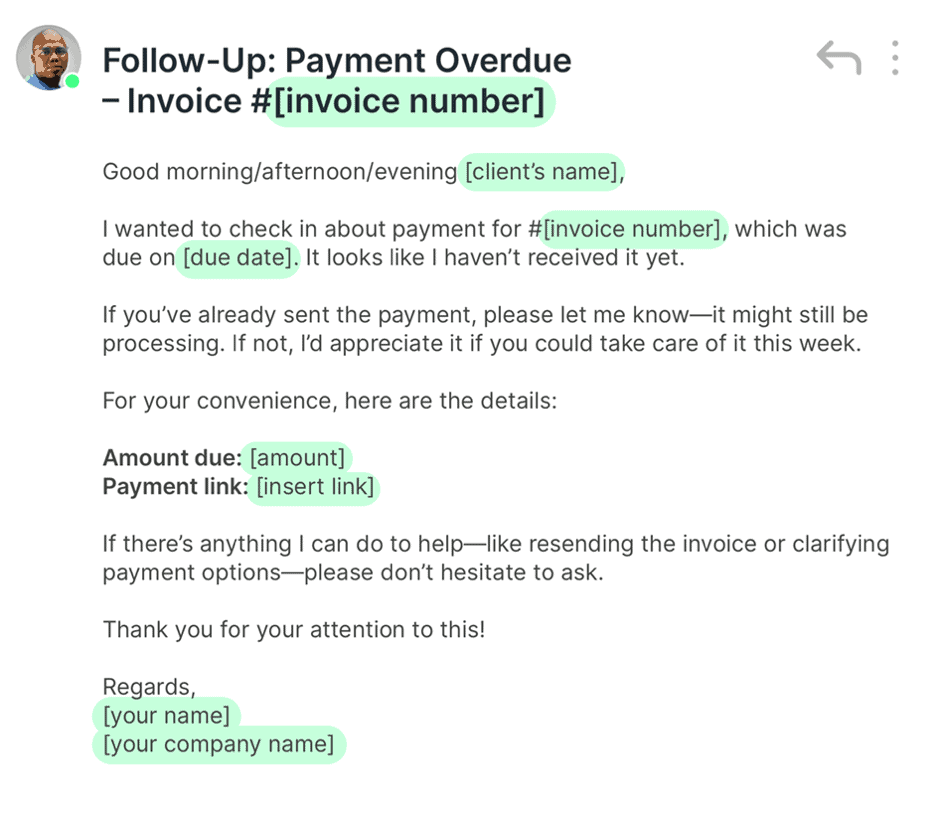

A systematic approach to payment reminders saves you time and reduces the emotional drain of chasing payments.

Image source: https://youcanbook.me/blog/payment-reminder-email

Smart Tips: Create an escalating sequence while maintaining a completely professional tone.

Pro tip: Automate these reminders through your accounting software to maintain consistency without consuming your valuable time. Designate a person who’s good at dealing with people patiently to handle phone calls.

The way you discuss payments from the very beginning sets the tone for your entire client relationship.

Smart Tips: Make sure all customers know how timely payments can create a win-win situation for both them and you.

Remember that your most valuable asset is the relationship you have with your client. When payment discussions become a normal, expected part of doing business, they lose their awkwardness and become just another professional interaction.

Getting paid on time isn’t just about assertiveness—it’s about creating systems that make prompt payment the path of least resistance for your clients. By implementing these subtle “nudges,” you’ll improve your cash flow while maintaining positive client relationships.

Most importantly, you’ll free up the mental energy currently spent worrying about late payments, allowing you to focus on what you do best: growing your business and serving your clients.

Don’t let large orders deter you. You don’t have to pay for supplies out of your pocket.