Merchant Cash Advance (MCA) Loans: A Strategic Guide for Small Businesses

MCAs have their place in the small business debt ecosystem. Use them as tactical and temporary cash infusers; not as a go-to solution for ongoing capital needs.

MCAs have their place in the small business debt ecosystem. Use them as tactical and temporary cash infusers; not as a go-to solution for ongoing capital needs.

You’re a small factory owner, and you just got hit with an unexpected equipment failure—the one that generates 30% of your revenue—and it is beyond repair.

You need $12,000 immediately to replace it, or you’ll lose customers—perhaps permanently—to China.

Your bank will take 4-6 weeks to process a loan application. You don’t even have 4-6 days.

This is exactly the situation where a merchant cash advance (MCA) becomes tempting. It promises funding in 24-48 hours with minimal documentation and no collateral required. But before you sign on the dotted line, you need to understand what you’re actually getting into.

Merchant cash advances are one of the most accessible, yet most expensive forms of business financing available. With approval rates reaching 80-90% and funding within 48 hours, they solve immediate cash needs that banks can’t address.

However, with APRs that can reach triple digits and aggressive daily repayment schedules, MCAs can also trap businesses in cycles of debt that destroy profitability.

Let’s break down everything you need to know about MCAs so you can make an informed decision—whether you’re considering one now or want to understand your options before an emergency hits.

A merchant cash advance is not technically a loan—it’s an advance against your future credit card sales. Here’s how it works: an MCA provider gives you a lump sum of cash upfront, and in exchange, you agree to remit a portion of your future credit or debit card sales (plus fees) until the advance is fully repaid.

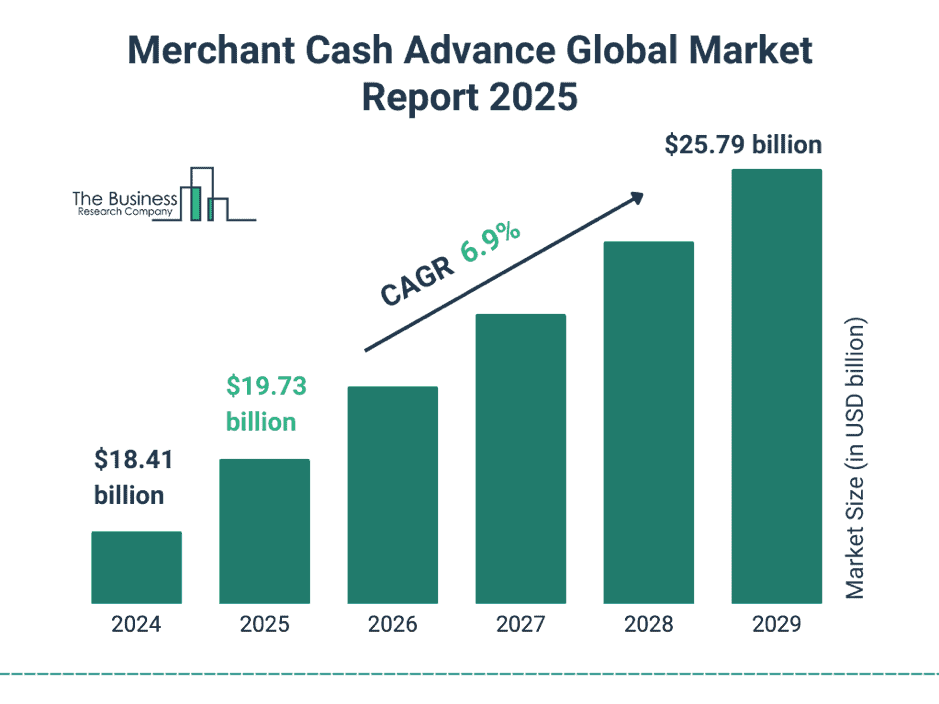

The global MCA market was valued at approximately $19.73 billion in 2025 and is projected to reach $25.79 billion by 2029, growing at a 6.9% CAGR.

Image source: thebusinessresearchcompany.com

This growth reflects increasing demand from small and medium-sized businesses that can’t access traditional bank financing.

The Critical Distinction – It’s NOT a Loan

Because MCAs are structured as purchases of future receivables rather than loans, they exist in a regulatory gray area. They’re not subject to usury laws that cap interest rates on traditional loans. This loophole allows some lenders to charge extremely high fees, making MCAs a costly financing option for many small businesses.

How Repayment Actually Works

MCAs use two primary repayment methods:

The percentage holdback model aligns with business cash flows and can be helpful if you have variable sales. However, it also means that during slow periods, the MCA still takes its percentage, potentially straining cash flow when you can least afford it.

MCAs don’t use traditional interest rates. Instead, they use factor rates—a multiplier applied to the advance amount to calculate total repayment.

How Factor Rates Work

Factor rates typically range from 1.09 to 1.5 or even higher. Here’s the math:

Say you receive a $50,000 MCA with a 1.3 factor rate.

That looks manageable until you convert it to APR. If you repay this advance over 6 months through daily deductions, your APR is approximately 60-70%. Over 12 months, it’s 30-35% APR. The shorter the repayment period, the higher the effective APR.

The Real Cost: APRs in Practice

According to current market data, MCA APRs now range from approximately 35% to over 300%, depending on provider and terms. When you include origination or closing fees along with the factor rate, APRs for merchant cash advances can reach triple digits.

Borrowing fees are typically 50% to 100% or more of the principal amount. This makes MCAs one of the most expensive forms of business financing available—far more costly than business lines of credit (7-20% APR), term loans (8-25% APR), or even business credit cards (15-25% APR).

Despite the high costs, MCAs serve specific business profiles effectively. The vast majority of MCA users in the U.S. are small businesses, with approximately 40% coming from retail, ecommerce, hospitality and logistics. Other industries using MCA funding include restaurants, construction, trucking, salons, auto repair shops, and healthcare practices.

These businesses collectively employ about 55 to 60 million workers in the USA.

What are some of the major reasons they go for merchant cash advances?

High Credit Card Volume: MCAs work best for businesses processing significant credit card transactions daily. If 70%+ of your revenue comes through card payments, MCAs can integrate seamlessly with your payment processor.

Credit Challenges: MCAs are accessible to applicants with credit scores below 600. Approval is based primarily on sales history rather than credit scores, making it an option for newer businesses or those with less-than-perfect credit.

Speed Requirements: Most MCA providers can approve and fund applications in 1-3 business days, much faster than traditional bank loans requiring 20-45 days.

Bank Rejection: With traditional loan rejection rates above 40%, many small businesses turn to MCAs after being declined by banks.

Need to infuse more capital into your business? Refused by multiple lenders?

Don’t sweat it. We can help.

One of MCA’s key selling points is the streamlined application process. As we head into 2026, technology has made this even faster and more accessible.

Typically, MCA providers ask for:

Notice what’s NOT required:

The Timeline

The application process is straightforward—most can be completed online in minutes, with funding possible within 24-48 hours after approval. According to current data, more than 60% of MCA approvals are issued within 48 hours:

This speed can be a lifesaver when you need capital immediately, but it can also lead to hasty decisions without proper evaluation of alternatives.

Approval Rates

Merchant cash advances are one of the most accessible financing options. According to the Federal Reserve’s Small Business Credit Survey, 58% of MCA applicants received at least partial funding, compared to only 30% for traditional small-business loans.

Other sources report MCA approval rates reaching 84-91%, particularly through fintech platforms using automated underwriting systems.

Let’s be direct: MCAs should almost never be your first financing choice. But there are specific scenarios where they might be appropriate.

When MCAs Might Work

Genuine Emergency with Clear ROI – If you have an unexpected crisis that will cost you more in lost revenue than the MCA will cost in fees, the math might work. Example: Your point-of-sale system crashes during peak season, and you’ll lose $5,000 daily in sales. A $20,000 MCA at a 1.4 factor rate ($28,000 total) might be worth it if you can’t operate without it.

Short-Term Opportunity – You can purchase deeply discounted inventory that will sell quickly at full margin, generating immediate profit that exceeds MCA costs.

Bridge Financing – You’re waiting on a large payment (insurance claim, major client payment, seasonal revenue) and just need to cover 30-60 days of expenses until funds arrive.

No Other Options Exist – You’ve been rejected by banks, don’t qualify for SBA loans, and have exhausted other financing sources. The alternative is business closure.

When MCAs Are Not to Be Used

Covering Operating Losses – Using expensive short-term funding to cover ongoing losses doesn’t solve the underlying problem—it makes it worse by adding expensive debt service to your existing cash flow challenges.

Long-Term Needs – MCAs are designed for short-term repayment (typically 3-18 months). Using them for long-term investments like equipment that will be productive for 5-10 years doesn’t make financial sense.

Debt Consolidation – Some businesses take new MCAs to pay off old ones, creating a cycle of increasingly expensive debt. This spiral rarely ends well.

Regular Working Capital – If you consistently need MCAs for regular working capital needs, you have a structural business problem that requires addressing, not ongoing expensive financing.

Beyond the obvious high costs, MCAs carry risks that aren’t immediately apparent:

Daily Payment Strain: MCAs have aggressive repayments that can disrupt profitability until they are repaid. Daily or weekly automatic deductions mean you’re constantly seeing money leave your account before you can use it for operations, payroll, or other critical needs.

If sales drop unexpectedly—seasonality, economic downturn, or competition—the fixed percentage or fixed payment continues regardless. This can create severe cash flow problems during periods when you most need cash reserves.

The Stacking Problem: Some businesses take multiple MCAs simultaneously—a practice called “stacking.” If you have three MCAs each taking 15% of daily sales, you’re remitting 45% of revenue to MCA providers before addressing any business expenses. This leaves insufficient cash for operations and creates a vicious cycle.

Lack of Regulation: Because MCAs aren’t technically loans, they’re not subject to federal lending regulations. This means:

Impact on Business Credit: A merchant cash advance may hurt your credit if it requires a personal guarantee or the lender reports missed payments or defaults to the credit bureaus. Even if not reported, defaulting could lead to collections or legal action, which can negatively affect your credit.

Refinancing Traps: Some MCAs allow you to refinance your cash advance if you need to extend the repayments. The trouble with refinancing is that most MCAs still require you to repay the total borrowing cost from the first advance. If you refinance, the new advance may calculate interest on the first advance’s borrowed amount plus fees—compounding your costs dramatically.

Want to explore quicker financing options without the predatory rates?

Before committing to an MCA, exhaust these alternatives:

Lines of credit offer revolving financing that can be simpler and less expensive than MCAs. Many don’t require stellar personal credit, and some can approve lines up to $250,000. Interest rates typically range from 7-20% APR—far better than MCA rates.

When to use: Ongoing working capital needs, seasonal cash flow gaps, emergency reserves

Timeline: 3-7 days for approval with established brokers like QualiFi

Bridge loans typically have more favorable terms than MCAs and can be funded in as little as 24 hours. While still more expensive than traditional bank loans, they typically offer lower APRs than MCAs.

When to use: Specific one-time needs with clear repayment source

Timeline: 1-3 days for approval and funding

If your need is equipment-related, specialized equipment financing uses the equipment as collateral, often resulting in rates of 8-20% APR versus MCA rates of 35-300%.

When to use: Purchasing or replacing business equipment

Timeline: 3-7 days with the right equipment financing broker

Invoice financing involves your business selling your accounts receivable to a third party at a discount. You receive 70-90% of invoice value immediately, with the remainder (minus fees) when your customer pays.

When to use: B2B businesses with outstanding invoices from creditworthy customers

Cost: Typically 1-5% of invoice value—much cheaper than MCAs

This is where companies like QualiFi provide enormous value. Instead of defaulting to an MCA because it’s fast and easy, a knowledgeable broker can:

We work with SMEs and businesses across retail, restaurants, and other MCA-typical industries but can usually find more favorable financing options through their lender network. Even if an MCA ends up being appropriate for your situation, a broker ensures you’re getting the best available terms rather than accepting the first offer you find.

Did you know there’s a dozen different types of loans available for small businesses?

If you’ve evaluated alternatives and determined an MCA is your best option, stick to these guidelines to minimize damage…

Calculate Total Cost Clearly

Don’t just look at the factor rate. Calculate

Use an MCA calculator to determine the total cost of borrowing and whether a merchant cash advance makes sense for your business.

Understand Repayment Terms Completely

Ask specific questions such as

Choose the Right Repayment Structure

Percentage of Sales – Better if sales are variable or seasonal. Payments automatically adjust with revenue.

Fixed ACH – Better if sales are very consistent and you want predictable payment amounts.

Plan for Repayment Before Borrowing

Have a specific plan for how you’ll generate the revenue to repay the advance plus fees while still covering normal operating expenses. If the numbers don’t work on paper, they won’t work in reality.

Start Small

If this is your first MCA, borrow less than you think you need to test how the repayment impacts your cash flow. You can always secure additional funding if needed, but you can’t undo an advance that’s destroying your cash flow.

Have an Exit Strategy

MCAs should be one-time solutions for specific situations, not ongoing financing. Before taking an MCA, plan how you’ll avoid needing another one. This might involve

As we enter 2026, several trends are reshaping the merchant cash advance industry:

Technology Integration – Most providers now offer fully digital applications that can be completed in minutes, while integrations with point-of-sale systems allow providers to verify sales and collect payments automatically. Some POS platforms, including Lightspeed, now offer their own MCA solutions, making access to funding even more seamless.

AI-Driven Underwriting – Advances in AI are speeding up the approval process by analyzing business performance data in real time. AI-powered risk tools in 2025 improve repayment predictions and enhance lending accuracy, potentially leading to more favorable terms for lower-risk businesses.

Increased Competition – With approval rates exceeding 70%, the MCA sector fulfills liquidity gaps in markets where traditional loans face rejection rates above 40%. More than 500 MCA providers operate worldwide, and more than 100 MCA companies expanded their ISO networks in recent years, increasing merchant acquisition by 30%. This competition may lead to more favorable terms for borrowers, though MCAs will likely remain expensive relative to traditional financing.

Regulatory Scrutiny – Increased awareness of predatory lending practices is leading to more regulatory attention. While MCAs aren’t currently subject to federal lending regulations, this may change as legislators recognize the need for consumer protection in the alternative lending space.

Merchant cash advances solve real problems for businesses that need immediate capital and can’t access traditional financing. The speed, accessibility, and minimal documentation requirements make them valuable tools in specific circumstances.

But they’re also among the most expensive financing options available, with APRs that can devastate profitability and daily repayments that strain cash flow. The businesses that succeed with MCAs use them strategically and sparingly—as emergency solutions with clear exit strategies, not as regular working capital sources.

Before pursuing an MCA:

As you plan your business financing for the year ahead, build relationships with finance brokers like QualiFi who can provide faster alternatives to MCAs with more favorable terms. With access to 75+ lenders and expertise across industries, brokers can often match MCA speed (24-72 hour approvals) while securing significantly lower costs.

What’s the difference between a merchant cash advance and a business loan?

MCAs aren’t loans—they’re advances against future credit card sales. You repay through daily percentage deductions from card transactions, not fixed monthly payments. MCAs use factor rates (1.2 to 1.5) instead of interest rates, aren’t regulated like loans, and don’t require collateral. Repayment timing varies with sales volume. Loans have fixed terms, regulated interest rates, and scheduled payments regardless of revenue fluctuations.

How much does a merchant cash advance really cost?

MCAs are expensive. Factor rates of 1.2 to 1.5 translate to APRs of 35-300%+. A $50,000 advance at 1.3 factor rate costs $65,000 total—$15,000 in fees (30% of advance). Over 6 months, that’s approximately 60-70% APR. Business loans typically cost 8-25% APR, making MCAs 3-10x more expensive than traditional financing for comparable situations.

How quickly can I get approved for an MCA?

Very fast—most MCA providers approve within 24-48 hours with funding in 2-3 days. Over 60% of approvals are issued within 48 hours. You need 3-6 months of credit card processing statements and basic business information. No extensive documentation, business plans, or collateral required. However, speed shouldn’t override careful evaluation of costs and alternatives.

What credit score do I need for a merchant cash advance?

MCAs are accessible with credit scores below 600, even as low as 500. Approval focuses on credit card sales volume and consistency rather than credit scores. This makes MCAs available when banks reject you. However, poor credit doesn’t justify accepting predatory pricing—explore alternatives like working with finance brokers who can access lenders specializing in challenged credit at better rates.

Can I pay off a merchant cash advance early?

Usually yes, but many MCAs charge prepayment penalties or require paying the full factor rate even with early payoff. Some refinance offers require repaying the original advance’s total cost plus new fees—compounding costs dramatically. Always ask about prepayment terms before signing.

When should I actually consider using an MCA?

Only for genuine emergencies with clear ROI where alternatives don’t exist: equipment failure during peak season, time-sensitive inventory opportunities, or bridge financing for 30-60 days until a major payment arrives. Never for covering operating losses, long-term needs, debt consolidation, or regular working capital. Exhaust all other alternatives first or work with a finance broker offering comparable speed with better terms.

Let us help you find the funding you need, within the time you need it.